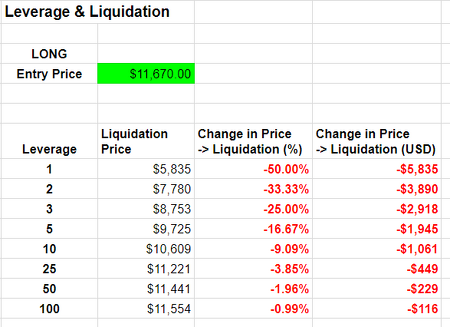

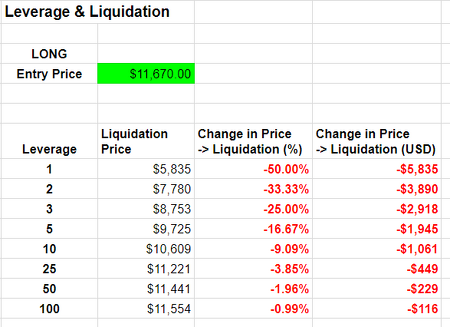

The two most dominant crypto margin trading platforms today are PrimeXBT and BitMEX, which both offer the crypto industry’s leading leverage allowance of up to 100x on Bitcoin trades. If you have 1 BTC, you go 100x, market increases 1%, you have 100% profit (you now have 2 btc on your balance if you close position), market decreases 1%, you lose everything (all of your margin is gone, you lose 100%). You can buy 1 Bitcoin ($11,670 at time of screenshot) with 0.1 BTC ($1,167) by buying a 10x leveraged position. You can also short the Bitcoin price (profit from a fall in its price) by Selling the Contract. In Yi’s case, he was expecting Bitcoin’s price to fall and so allegedly entered a short position of 2,000 BTC.

What is 100x leverage?

The greater the leverage, the smaller the loss. With the maximum 100x leverage the loss is 0.5212 Bitcoin, about $5,700 or 1.15% of the $495,600 position. For market trades fees are 0.075% of your position. So total fees on a $1,000 trade with 100x leverage are $150 [100 x $1,000 x 0.00075 x 2].

As the price crashed down to 400 from 500, many seasonal traders found this opportunity to call long positions on small leverage towards the upside risk 420. They eventually covered up their losses as the price literally bounced back above 420 to test the primary upside risk near 440.

Why is leveraged bitcoin trading so appealing?

To leverage a position means basically that you borrow funds to be able to increase the position size in contracts while using less from your capital/margin. Depending on how you use this tool it can decrease the risk by decreasing the used capital and set funds free for other trades. At the same time, it can increase your chances of getting liquidated.

In the end, cross margin is interesting for scalping and/or swing trading. It avoids the excessive fluctuations that crypto currencies are so familiar with, by using all of your capital to cover your position. But be careful, because without a stop loss, the cross can very quickly become your worst nightmare and considerably reduce your capital and in some cases make you lose everything. When trading bitcoin, BitMEX charges a taker fee of 0.075% of the total position if you use the “Market” tab when opening a position. However, if you select the “Limit” tab to become a market maker, you’ll actually receive a rebate of 0.025% of your total position.

This also provides the opportunity to increase the size of your trades using leverage. Trading using leverage is trading on credit by depositing a small amount of cash and then borrowing a more substantial amount of cash. For example, a trade on the EURfutures markethas a contract value of $125,000, but by using leverage, the same trade can be made with approximately $6,000 in cash.

Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an eToro Community Member is not a reliable indicator of his future performance. Content on eToro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of eToro – Your Social Investment Network.

The Next Generation of Bitcoin Trading Products

The money in a margin account is only used as collateral for the loan or in settling debt with the lender. Currency trading often involves investors using leverage to try and profit from both price fluctuations and differences in exchange rates. Leverage is simply a loan provided to an investor by a broker or exchange that controls the investor’s trading account. Once an investor has secured the additional funds, they need to embark on margin trading. There were still some who actually managed to avoid losses during such unannounced price movements.

Leverage warnings are provided by financial agencies, such as the U.S.Securities and Exchange Commission(SEC), and brokerages that offer to trade using leverage. These warnings remind you that trading using leverage carries a high degree of risk to your capital; it is possible to lose more than your initial investment, and you should only speculate with money you can afford to lose. Last year, between 14th August to 18th August 2014, the Bitcoin price fell nearly $100 on all the major exchanges — an event that was famously referred as flash crash. Many experts interpreted the crash to have been caused by margin trading — a kind of leverage system that requires traders to deposit collateral to cover credit risk.

If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. However, if the market moves against you and you’re in loss, your trade will automatically be closed and your collateral liquidated when the market reaches a certain price – this is known as the liquidation price. If you long Bitcoin by trading on leverage (margin trading), you can profit when the price of Bitcoin increases.

Margin trading with leverage allows traders to open both long and short positions, meaning they can profit from both rising and falling markets. In 2019, the popularity of leverage trading (aka margin trading) has grown considerably in Bitcoin and Cryptocurrency markets. This trend can be seen with the comparable growth of the trading platforms that provide the possibility to trade with leverage. Also, with existing and major exchanges that have recently adapted their platforms to incorporate it, or increased their leverage allowance to meet the increasing demand. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange.

At the same time, it is important to notice that only those professional traders managed to go home with profits who were limitedly dependent on leveraged trades. Indeed, they were focused more on managing near-term risks rather then fantasying massive returns. To cut a long story short, they understood how Bitcoin volatility could put a dent on their leverage if their prediction goes invalid; and therefore they borrowed less and played only for small gains by setting proper price limits.

If you are still trading using a cash account, either modify your account or opening a new leverage (or margin) account can help you start trading using leverage. While BitMEX offers several cryptocurrencies to trade, all profits and losses are settled in bitcoin, which BitMEX refers to as XBT (instead of the more often seen BTC). As a result, users must deposit and withdraw funds in bitcoin, rather than dollars, even though dollars are what the platform’s cryptocurrencies are traded against. Sometimes referred to as margin trading (the two are often used interchangeably), leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance.

While it is true that high leverage yields high returns, the same is applicable in the case of losses as well. So if you would trade, say a larger amount like $50,000 on your original capital $1,000, you would end up making a whopping $5,000 return.

- Essentially, individuals with a limited amount of crypto-capital can add leverage to their base investment.

- Exchanges like Bitfinex, Bitmex, Kraken, Bittrex, and Poloniex all offer these types of trades, and some of them allow other customers to provide the lending material.

After earning the title of the worst investment of the year 2014, Bitcoin Trading may not need any further introduction when it comes to potential risks and losses. However at the same time, the market has been a haven for disciplined day traders that normally end up earning a greater returns within a shorter period of time. Now – this is something many novice traders tend to think or ask themselve. Switching the leverage button does not increase your profits, but decreases your risk a.k.a. your actual used margin on the position.

In July 2018, believe it or not, the big broker firm reached 1,000,000 Bitcoin being traded on their platform on a single day. At a price level of round about 7000 USD that’s a total US Dollar value of about 7 billion.

Trading using leverage does not is increase the risk of a trade; it is the same amount of risk as using cash. Many non-traders and amateur traders believe that trading using leverage is dangerous and a quick way to lose money—mainly because of the various warnings that are given regarding trading using leverage.

As you can see the price of XBT would have to reach a price out of imagination to liquidate my short position. With a 5 Bitcoin sized account, I can take easily a contract sized short position without risking a liquidation.

This is because the size of a position is greatly increased using ‘someone else’s money’. In other words, a broker or an exchange lends you money to trade. But while it can be highly profitable if a trade goes your way, the losses are greatly magnified if the opposite happens.

Trade with 1:100 Leverage

Exchanges like Bitfinex, Bitmex, Kraken, Bittrex, and Poloniex all offer these types of trades, and some of them allow other customers to provide the lending material. The risk a margin trader deals with is that they are gambling with loaned money and the market may not follow their predictions. Many people trade bitcoin on exchanges and understand how to place a buy or sell order and interact with the trading platform’s operations. Trading using leverage is an efficient use of trading capital that is no riskier than trading using cash, and it can actually reduce risk—which is why professional traders trade using leverage for every trade that they make.

By employing 100x leverage, Yi was effectively trading with 200,000 Bitcoins! Consequently, Bitcoin only needed to go up 1 percent from the entry price for Yi to lose all the funds.

On Cross, the above position would initially deduct 0.2967 BTC from my total margin and once we can bullet proof the trade with stop/loss at entry, we can go 100x if we want, using the same amount of the account. Even if we cannot get liquidated with a position like the one above, setting up a stop-loss is advisable. You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Cryptocurrencies markets are unregulated services which are not governed by any specific European regulatory framework (including MiFID). Trading with eToro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders.

Essentially, individuals with a limited amount of crypto-capital can add leverage to their base investment. For instance, if you hold two bitcoins the exchange allows you to open a margin position with leverage (loaned money) based on your initial capital.

Chinese Bitcoin Trader Commits Suicide after Losing 2,000 BTC on 100x Leverage Bet

The reality is that professional traderstrade using leveragebecause it is an efficient use of their capital. There are many advantages to trading using leverage, but there are minimal disadvantages. Trading using leverage allows traders to trade markets that would otherwise be unavailable and allows them to trade more contracts (or shares,forexlots, etc.) than they would otherwise be able to afford.